PROFITS TAX

General information

Persons, including corporations, partnerships, trustees and bodies of persons carrying on any trade, profession or business in Hong Kong are chargeable to tax on all profits (excluding profits arising from the sale of capital assets) arising in or derived from Hong Kong from such trade, profession or business. There is therefore no distinction made between residents and non-residents.

Taxpayer’s duty

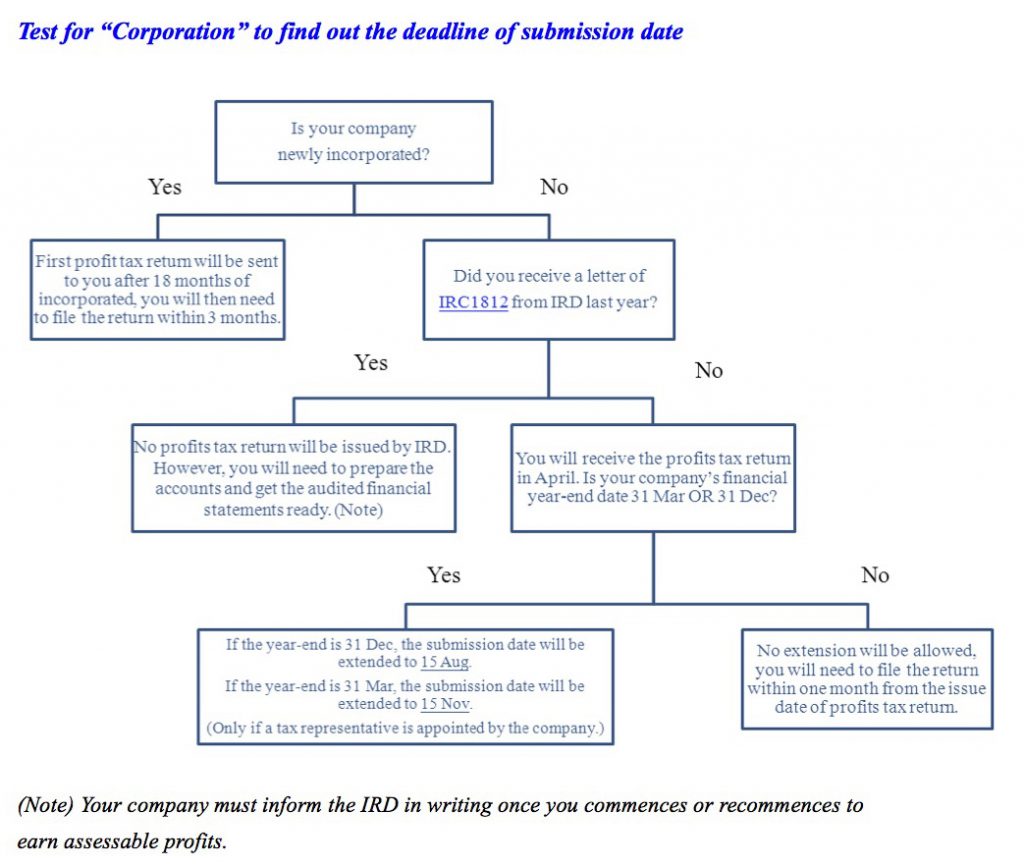

Inland Revenue Department (IRD) will normally issue first profits tax return after 18 months of company incorporations.

In subsequent year of assessment, IRD will issue the profit tax return in April.

In normal situation, tax return has to be filed to IRD within 1 month (first return: within 3 months) of issuing, or the authorized representatives may apply the extension of time for submission for taxpayers.

For “Corporations” (Limited company), profit tax return filing has to be attached with audited financial statements and tax computation for tax assessment purposes.

Late filing of tax return, it is an offense. It will lead to a fine or even prosecutions.

Here is the simple test for “Corporation” to find out the deadline of submission date: “Click me”.